Business Segments

With the successful sale of the Lithography division to ZEISS SMT and a clear focus on the space business, Beyond Gravity has set the course for the future in 2024. As part of the divestment portfolio of RUAG International, RUAG Aerostructures Switzerland Ltd reached a milestone with the sale of the company to Pilatus Flugzeugwerke AG....

Beyond Gravity

- Net sales

- 448 mCHF

- EBIT

- -8.4 mCHF

- Employees (FTE)

- 1540

With the successful sale of the Lithography division to ZEISS SMT and a clear focus on the space business, Beyond Gravity has set the course for the future in 2024. However, due to operational challenges in the Launchers division and additional costs for the “EZYone” transformation program, the operating result is clearly negative. Nevertheless, the company is well positioned to profitably take advantage of opportunities in the dynamic space market. This is underscored by the well-filled order book and the strong performance of the Satellites division.

Strong growth in the space market

Despite last year's high inflation and geopolitical tensions, the space industry has proven that it can continue to grow at an above-average rate even in turbulent times. In 2023, the global space economy reached a volume of USD 570 billion, which corresponds to a growth rate of 7.4% compared to the previous year. The commercial sector contributed significantly to this with USD 445 billion (78% of the total volume). Government spending also increased by 11%, underlining the strategic importance of space. The market environment for Beyond Gravity developed positively overall, particularly in view of the increasing demand for rocket launches, the expansion of satellite infrastructure and the sustained investments by commercial players.

By 2035, the space economy is expected to grow to USD 1.8 trillion, driven by a projected annual growth rate of 9%, which is significantly higher than global GDP. The main drivers are falling costs for rocket launches (down 90% in the last 20 years), private investment and the growing demand for space-based technologies such as communication, navigation and Earth observation.

Beyond Gravity: Solid foundations for long-term success

With its leading expertise in many product areas, the trust of its customers built up over many decades, its innovation strength and the transformation programs it has initiated, Beyond Gravity is ideally positioned to successfully exploit the opportunities in this dynamic market environment. One impressive example of this is the delivery of key components for the successful first flights of the new European launch vehicle Ariane 6 and the American Vulcan Centaur manufactured by ULA. In addition, the company supported major space missions such as the HERA planetary protection mission by providing key satellite components.

Net sales of RUAG International's Space segment increased by 11.6% from CHF 383.4 million to CHF 448 million in the year under review. Adjusted for exchange rate effects, the increase amounted to 16%. Excluding the Lithography division, which was sold on December 1, 2024, net sales of the remaining Launchers and Satellites divisions amounted to CHF 359 million (previous year: CHF 315 million).

Earnings before interest and taxes (EBIT) decreased from CHF 0.1 million to CHF -8.4 million. However, this result includes portfolio effects from the sale of business units. Adjusted for these effects, the EBIT of the Satellites and Launchers divisions amounted to CHF -112 million (previous year: CHF -14 million), reflecting a significant decrease compared to the previous year.

Results were primarily impacted by operational challenges in the Launchers division. These resulted from the ongoing transition to series production in the new production facilities and from product improvements initiated in response to new findings from ongoing missions. These factors led to temporary efficiency losses, additional costs and delivery delays. Additional costs for the ongoing transformation program “EZYone”, low margins in some product areas and increasing regulatory requirements – for example for the implementation of the adjustments associated with the Cybersecurity Maturity Model Certification (CMMC) – also had a negative impact on the result.

At the same time, new orders from major commercial space providers such as MDA Space ensured a robust order intake. This led to an increase in the order backlog of CHF 122.9 million to a total of CHF 851.5 million at the end of December 2024.

Satellites division: Basis for sustainable profitability established

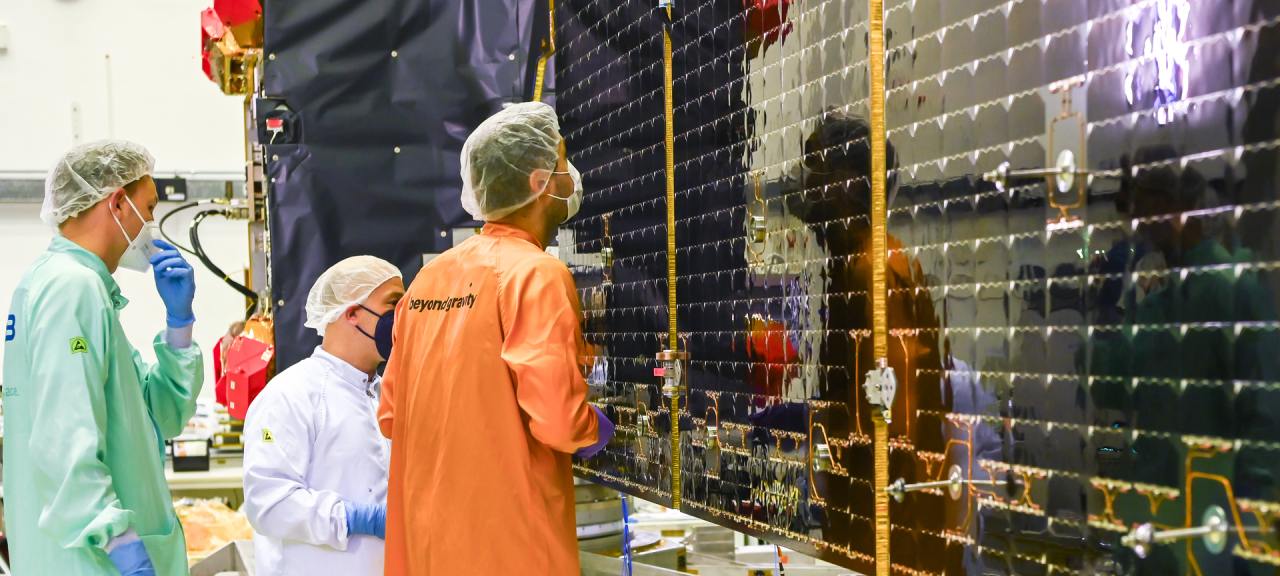

Beyond Gravity combines all activities in the satellite sector and the associated data business in the Satellites division. The focus is on selected components and systems for satellites, including satellite structures, on-board computers, navigation receivers and other electronics, thermal protection and various mechanisms from alignment systems to slip rings.

In addition to outstanding engineering, the division's core competencies include production and project management. In these areas, Beyond Gravity has established itself as a leading supplier in both the commercial and institutional markets. The company is a market leader in product areas such as navigation receivers, on-board computers and thermal insulation.

During the reporting period, the division achieved a turnaround towards sustainable profitability, not least thanks to a targeted review and streamlining of the project portfolio and by increasing the profitability of individual projects. The bulging order book is particularly encouraging. During the reporting period, it benefited significantly from a major order won in August from the Canadian aerospace company MDA Space to supply on-board computers for several satellite constellations.

The division also invested heavily in research and development and pushed ahead with the standardization and industrialization of production. Around 800 employees work at the sites in Nyon and Zurich (Switzerland), Gothenburg (Sweden), Vienna (Austria), Titusville (USA) and Tampere (Finland). Since 2023, the division has been headed by Oliver Grassmann.

Launchers division: Capacity expansion, series production and full order books

The Launchers division brings together all of Beyond Gravity activities related to the design and manufacturing of composite structures for launch vehicles. Core products include payload fairings, interstage and payload adapters, as well as satellite dispensers and separation systems. For many years, leading space companies such as Amazon, ArianeGroup, United Launch Alliance and other partners in Europe, the USA, Asia and Australia have relied on the quality of Beyond Gravity's products for their launch vehicles.

In April and August 2024, after several years of construction, Beyond Gravity opened two new, state-of-the-art production facilities in Decatur (USA) and Linköping (Sweden). The facilities are equipped with innovative technology for the manufacture of payload fairings (Decatur) and satellite dispenser systems (Linköping) and double the production capacities at both sites. Thanks to partially automated manufacturing processes designed for series production, Beyond Gravity can meet the increasing demands of its customers in terms of volume and speed even more efficiently. The facilities are currently in the start-up phase, and production is expected to reach full capacity by mid-2025.

The Launchers division faced operational challenges in the year under review and delivered a significantly negative operating result. The ramp-up of the new production facilities in Sweden and the USA, the transition to series production and necessary product improvements based on new findings from ongoing missions weighed on the result. At the same time, these steps have provided valuable insights that are being directly incorporated into the further development of the products. Supply chain challenges also arose in connection with the series production of dispenser systems for the Kuiper satellite project. The division has taken appropriate measures to actively manage the associated risks, to ensure continuity of production and to manufacture the affected components internally in the future. It is encouraging that the division was able to win a significant development and production order for payload fairings from a new commercial customer during the reporting period, which further increased the order backlog.

The division also invested in innovations, such as in the area of reusable payload fairings, and pushed ahead with the standardization and industrialization of its processes. The division employs a total of 740 people in Emmen and Zurich (Switzerland), Linköping (Sweden) and Decatur (USA). Paul Horstink has been head of the division since 2022.

Lithography division: Strong results and new prospects with ZEISS SMT

The Lithography division, with over 200 employees at its two sites in Zurich (Switzerland) and Coswig (Germany), manufactures high-precision apertures, actuators, and measuring and testing instruments for nanometer-precise semiconductor manufacturing. These mechanisms for controlling optical systems are used in machines for manufacturing microchips and form the basis for countless high-tech applications.

In the 2024 financial year until sale, the Lithography division closed with solid results in new orders, operating sales and EBIT. In the reporting year, it manufactured a high-precision instrument for measuring mirrors and optics for microchip production that accelerates the manufacturing processes compared to previous measuring machines. In addition, cleanroom capacity was doubled to achieve production increases. Dr. Oliver Kunz has headed up the division since 2022.

In September 2024, Beyond Gravity and ZEISS Semiconductor Manufacturing Technology (SMT) agreed on the acquisition of the Lithography division and all its employees in Germany and Switzerland. After a short transition phase, the change of ownership was successfully completed at the beginning of December. The German part of the business in Coswig has been integrated into Carl Zeiss SMT GmbH, while the Swiss part in Zurich has been transferred to Carl Zeiss SMT Switzerland AG as a subsidiary. The new owner offers exciting development opportunities for employees and the ideal environment to consolidate the division's technological leadership. Going forward, Beyond Gravity will therefore focus entirely on its space activities.

Transformation: A new approach to efficiency and integration

The “EZYone” initiative, launched in 2023 to transform Beyond Gravity's business processes and digital infrastructure, aims to harmonize business processes worldwide across all locations, create a unified digital core and consolidate all central IT systems. This will enable more efficient management of product lifecycles, resources and production processes. It also allows the company to make optimal use of the strengths that arise from the intelligent interaction of its global locations.

After a program reset in May 2024, the revision of the roll-out plan and the securing of additional investments, the new system was successfully implemented at the Lisbon site at the beginning of November 2024. Implementation in the Corporate Services division in Switzerland and at the two Swedish sites will follow in the first quarter of 2025.

People & Culture: Attracting talent, strengthening culture

In the reporting year, Beyond Gravity reached key milestones in the area of People & Culture. Highlights include the targeted recruitment of talent for the growing sites, the introduction of a new employer brand based on the slogan ‘Challenge the Impossible’, the further development of performance assessment management, and a new program to develop leadership skills. In addition, the company has invested in further improving the work environment at numerous sites, most recently at our Digital & Innovation Hub in Lisbon.

Outlook: Seizing opportunities, securing growth

The growing demand for rocket launches, the expansion of satellite infrastructure and the continued investments of commercial players are creating a promising market environment for Beyond Gravity. With the sale of the Lithography division, the company is concentrating on its strategic role as a key supplier to the global space industry. The focus is on expanding profitable projects, innovative business areas in the context of the ‘New Space Economy’ and strengthening long-term customer partnerships.

Beyond Gravity will continue to consistently pursue the path of transformation and invest in its attractiveness as an employer to attract and retain talent in the long term. The successful commissioning of the new production facilities and the realization of the associated production potential will create the basis for making the best possible use of opportunities in the dynamic space market. With the highest standards of quality and on-time delivery, the company remains focused on sustainable growth.

RUAG Aerostructures

- Net sales

- 48 mCHF

- EBIT

- 18 mCHF

- Employees (FTE)

- 100

RUAG Aerostructures Switzerland Ltd is a leading supplier of customized solutions for the production and assembly of complex components for civil and military aviation. As part of the divestment portfolio of RUAG International, RUAG Aerostructures Switzerland Ltd reached an important milestone in the implementation of the strategy defined by its owner, the Swiss Confederation, with the sale of the company to Pilatus Flugzeugwerke AG at the beginning of 2024.

RUAG Aerostructures Switzerland Ltd ended the 2024 financial year with a positive result. Production and the resulting sales showed good margins and EBIT was positively influenced by the early reductions of framework agreements and further savings within the organization. In addition, balanced cash management led to a good, stable free cash flow result. It should be noted that the sale of business units limits the comparability of the key figures in this annual report with the previous year.

Sales in 2024 totaled CHF 47.6 million (previous year CHF 239.8 million). EBIT rose significantly from CHF –17.2 million in the previous year to CHF 17.6 million. Compared to the previous year, the reliability and punctuality of suppliers was further improved by smooth production. In addition, the optimized supply chain organization, including the reintegration of the entire logistics, led to a significant improvement in the availability of the required production materials. In this context, the purchase quantities were also determined in close coordination with customers as part of the strategic alignment. This meant that all customer orders could be produced and delivered as agreed. In addition to these factors, the asset deal with Pilatus also had a positive impact on the overall result.

Focus 2024: Transition from RUAG Aerostructures to Pilatus

The contract for the sale of RUAG Aerostructures Switzerland Ltd to Pilatus Flugzeugwerke AG was signed in January 2024. This enabled Pilatus to take over the entire production of RUAG Aerostructures Switzerland at the Emmen site with around 130 employees as of May 1, 2024, in an initial step.

RUAG Aerostructures Switzerland will remain in existence as a company for the time being in order to fulfill the remaining non-Pilatus customer commitments, but will not accept any new orders. In order to fulfill these commitments, RUAG Aerostructures Switzerland and Pilatus are working hand in hand to ensure that all orders can be completed on time, to the desired quality and within budget. The remaining 100 employees will be transferred to Pilatus in stages as the non-Pilatus programs are completed.

With another business partner, RUAG Aerostructures Switzerland has agreed that it will produce additional parts for winglet shipsets for a third-party customer until the end of March. At the same time, RUAG Aerostructures is supporting its partner in ramping up production.

Outlook

The focus for 2025 remains on the transition to Pilatus and the completion of the various non-Pilatus programs, which will be completed by the end of March 2025.

This will enable RUAG Aerostructures to hand over all production areas to Pilatus by the end of June. By the end of September, the warehouse will be cleared and the last materials and tools will be sent back to the customers. Once all physical assets have been cleared, RUAG Aerostructures will be transferred to the Group as a legal entity for the final ramp-down steps, so that the last remaining employees can be transferred to Pilatus on January 1, 2026.

Pilatus intends to expand its own production at the Emmen site in the medium to long term and create further jobs.